Introduction

The home loan approval process can be a daunting task for many prospective homeowners. Ensuring that all the necessary documents are in order and understanding the various stages involved can significantly streamline the process. This guide aims to demystify the home loan approval process, highlight the essential documents required, and offer practical tips to make the journey smoother. Additionally, we’ll emphasize the importance of accurate and professionally edited documents, showcasing our home approval package services and home approval package loan services as key resources.

Understanding the Home Loan Approval Process

What is the Home Loan Approval Process?

The home loan approval process involves several stages that a borrower must go through to secure a mortgage. These stages include pre-approval, application, processing, underwriting, and closing. Understanding each stage is crucial to navigating the process effectively.Key Stages of the Approval Process:

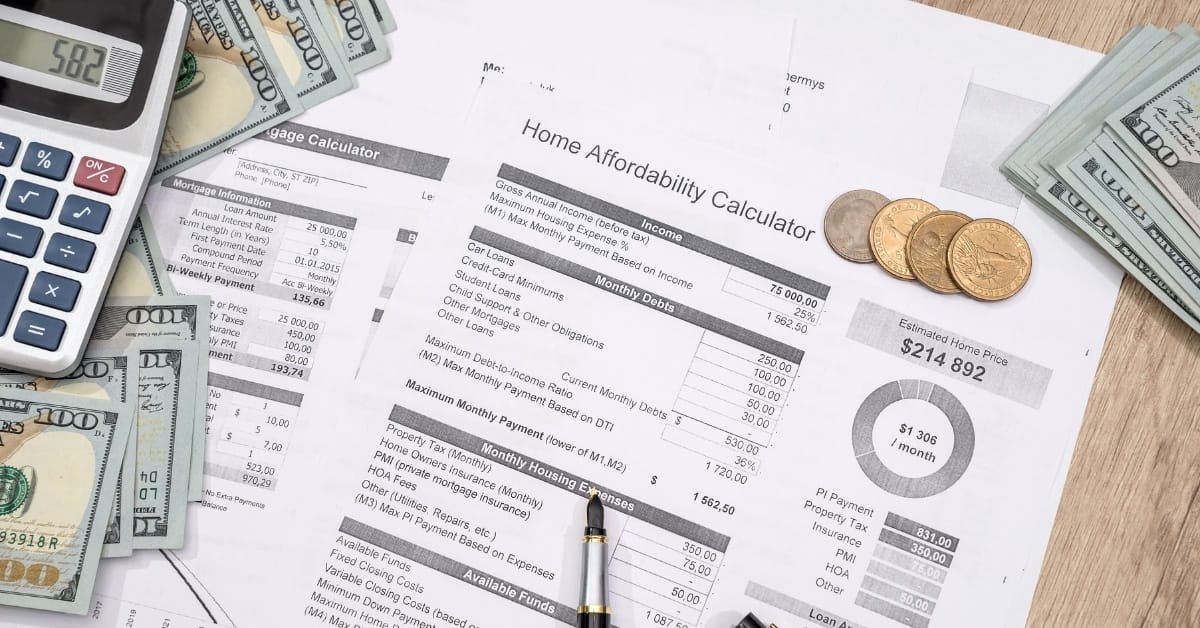

- Pre-approval: This initial step involves evaluating your creditworthiness and determining how much you can borrow.

- Application: Submitting a formal mortgage application along with required documents.

- Processing: The lender reviews and verifies all information provided.

- Underwriting: The underwriter assesses the risk and determines whether to approve the loan.

- Closing: Finalizing the loan, signing documents, and transferring ownership.

Essential Documents for Home Loan Approval

Having the right documents prepared and organized can expedite the home loan approval process. Here are the key documents you’ll need:Proof of Income

- Pay Stubs: Recent pay stubs covering at least the last 30 days.

- Tax Returns: Copies of your tax returns for the past two years.

- Employment Verification: A letter from your employer verifying your employment status and income.

Credit History

- Credit Reports: Your credit reports from all three major credit bureaus.

- Credit Scores: Your current credit scores, which the lender will review.

Assets Documentation

- Bank Statements: Recent statements for all checking and savings accounts.

- Retirement Accounts: Statements for any retirement accounts, such as 401(k) or IRA.

- Investments: Documentation of any other investments, such as stocks or bonds.

Property Information

- Purchase Agreement: The signed agreement between you and the seller.

- Property Details: Information about the property, including the address and description.

- Appraisal: An appraisal report confirming the property’s value.

Personal Identification

- Government-Issued ID: A valid driver’s license or passport.

- Social Security Number: Your Social Security card or a document showing your SSN.

Common Mistakes in Home Loan Applications and How to Avoid Them

Avoiding common mistakes can greatly improve your chances of a smooth home loan approval process. Here are some frequent errors and tips to avoid them:Inaccurate Information

Ensuring all information on your application is accurate and up-to-date is crucial. Incorrect details can delay the process or result in denial. Double-check all entries before submission.Missing Documents

Incomplete applications can cause significant delays. Keep a checklist of required documents and ensure everything is included. Our home approval package loan services can help ensure you have all necessary paperwork.Low Credit Score

A low credit score can affect your eligibility for a loan. Improve your score by paying off debts, making timely payments, and correcting any errors on your credit report.Unverified Income

Lenders need to verify your income. Make sure all income is properly documented and verifiable. Use professional editing services to ensure your documents are accurate.Ignoring Pre-Approval

Getting pre-approved before house hunting can give you a clear idea of your budget and show sellers you are serious. Pre-approval can also speed up the final approval process.Tips to Streamline the Home Loan Approval Process

Here are some tips to help streamline the home loan approval process:Get Pre-Approved

Pre-approval gives you a clear understanding of how much you can borrow and boosts your credibility with sellers. It involves a preliminary review of your financial situation by the lender.Organize Your Documents

Keep all required documents organized and readily accessible. This includes income proofs, credit reports, asset documentation, and personal identification. Using our home approval package services can help ensure everything is in order.Work with a Mortgage Broker

A mortgage broker can guide you through the process, help you find the best rates, and ensure all documents are in order. Their expertise can be invaluable in navigating the complexities of mortgage approval.Maintain Financial Stability

Avoid major financial changes, such as switching jobs or making large purchases, during the approval process. Stability in your financial situation can increase your chances of approval.Use Professional Document Editing Services

Accurate and professionally formatted documents can make a significant difference. Professional editing services, like those offered by Edit My Bank Statement, ensure that your documents are error-free and professionally presented.The Importance of Professional Document Editing Services

Professional document editing services play a crucial role in ensuring the accuracy and reliability of your home loan documents. Here’s why you should consider using them:Expertise and Accuracy

Professional editors have the expertise to ensure your documents meet all lender requirements and are free from errors. This can significantly enhance your chances of approval.Preventing Errors and Omissions

Editing services help prevent common mistakes and omissions that can delay the approval process. They ensure all information is accurate and complete.Time-Saving and Efficiency

Outsourcing document editing saves you time and effort. It allows you to focus on other aspects of the home buying process while ensuring your documents are handled professionally.Enhanced Credibility

Accurate and professionally formatted documents enhance your credibility with lenders. It shows that you are serious and well-prepared, increasing your chances of securing the loan.Case Studies and Success Stories

Example 1: First-Time Homebuyer Success

A first-time homebuyer was struggling with the document preparation process. By using our home approval package services, they were able to organize their documents, correct errors, and secure their loan approval smoothly.Example 2: Streamlining a Complicated Loan Process

A borrower with a complex financial situation used our professional editing services to ensure all documents were accurate and compliant. This helped them navigate the approval process efficiently and get their loan approved without delays.Conclusion

The home loan approval process can be simplified with the right approach and preparation. By understanding the process, organizing your documents, and avoiding common mistakes, you can enhance your chances of securing a loan. Professional document editing services play a crucial role in ensuring your documents are accurate and compliant, making the approval process smoother and more efficient.Call to Action

Ready to simplify your home loan approval process? Contact us today for expert document editing services or explore our comprehensive range of home approval packages to find the perfect solution for your needs.Frequently Asked Questions

The home loan approval process involves several stages including pre-approval, application, processing, underwriting, and closing. Each stage has specific requirements and steps to follow.

Essential documents include proof of income, credit history, assets documentation, property information, and personal identification. Using our home approval package loan services can help ensure you have all necessary documents.

Avoid mistakes by ensuring all information is accurate, including all required documents, improving your credit score, verifying income, and getting pre-approved. Professional document editing services can also help.

Professional document editing services ensure accuracy, prevent errors, save time, and enhance your credibility with lenders. They help streamline the approval process.

Choose a service with a strong reputation, client reviews, and a comprehensive range of services. Consider our home approval package services for professional and reliable editing.